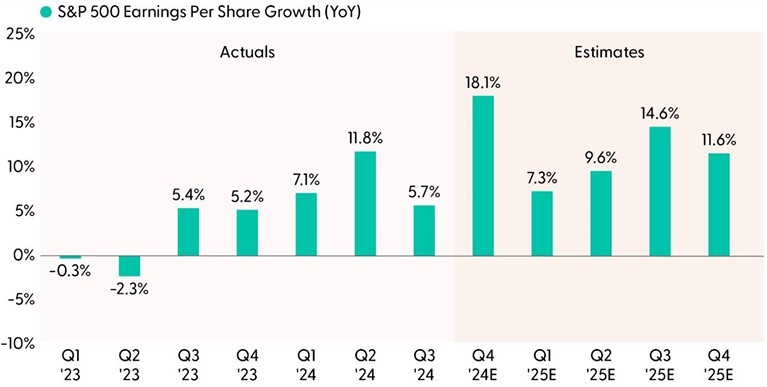

Fourth quarter earnings season is nearly complete, and it has been a good one. S&P 500 companies grew profits more than 18% year over year, according to FactSet data, with mega cap technology and financial companies doing most of the heavy lifting (about seven points of growth came from each). The Magnificent Seven grew earnings by an average of 37% and financials earnings jumped 50%. But the road ahead gets tougher. With new tariffs in place and more likely on the way, on top of mounting evidence that the U.S. economy is slowing, achieving double-digit earnings growth in 2025, as many expect, will be a tall task.

Big Numbers

Six weeks ago in our fourth quarter earnings preview, we wrote that we expected modest upside to the 12% consensus estimate for Q4 S&P 500 earnings growth. That turned out to be too pessimistic because corporate America delivered more than 6% average earnings upside — hardly modest. We expected economic growth to offset currency headwinds, but underestimated the amount of margin improvement companies could achieve, their ability to manage policy uncertainty, and upside in financials. Operating margins rose a full point year over year, while financials generated average earnings upside of 13%, compared to 8% in the prior quarter.

Strong Earnings Outlook Intact After Big Quarter but Tariff Overhang Lingers

Source: LPL Research, FactSet, 02/27/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Perhaps the toughest test this earnings season was around maintaining the optimistic earnings outlook for 2025. As we wrote in our preview commentary:

“The key to the market’s reaction to results will be whether guidance is upbeat enough to keep market expectations for double-digit earnings gains in 2025 intact. To that end, trade policy expectations will be important factors.”

Estimates held up well enough to keep that double-digit earnings growth outlook within reach — it just may be a bit of a stretch depending on how hard tariffs hit and how much the economy slows. Market reactions to earnings beats and misses have been near historical averages, suggesting overall results and outlooks met expectations.

Improving Manufacturing Outlook Bodes Well

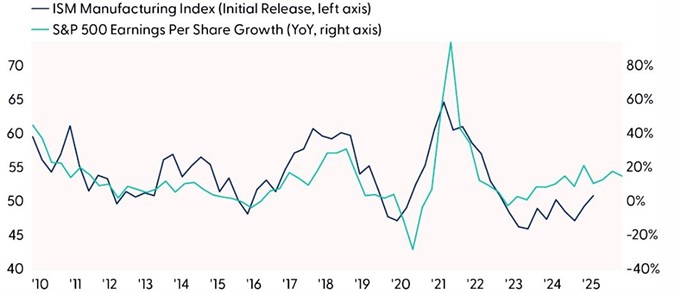

An improving manufacturing outlook was supportive late last year. Historically, the Institute for Supply Management (ISM) Manufacturing Index has correlated well with S&P 500 earnings growth because earnings are more manufacturing-driven than the more consumer-oriented economy.

The accompanying chart illustrates the recent improvement in the outlook for manufacturing activity. Remember, this survey measures expectations — whether companies expect to spend more or less — so it tends to signal near term earnings direction. That means the improvement from a contractionary reading of 47.2 in September up to an expansionary 50.9 in January points to further earnings gains ahead. The new orders reading from the ISM, which is more forward-looking, has had an even bigger move — from 46.1 in September to a firmly expansionary 55.1 in January.

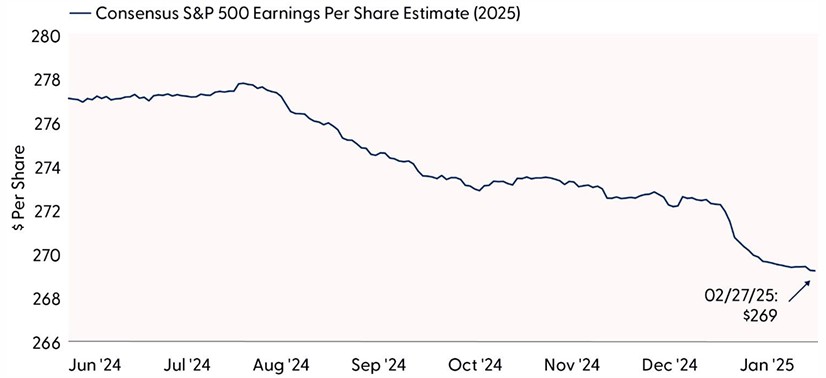

However, healthy economic activity in the fourth quarter and optimism from manufacturers was not enough to overcome downward pressure on estimates — the consensus S&P 500 earnings per share (EPS) estimate for the first quarter was cut by about 5% over the past six weeks. Near-quarter estimates almost always get cut by 2–3%, potentially more as a new year begins. Plus, the currency headwind stiffened into reporting season, tamping down on guidance. Earnings still could grow 10% in the first quarter, but corporate America will need help from the economy, including more productivity, less inflation, and lower interest rates. Policy matters too, of course, where tariffs remain a big wildcard.

Manufacturing Activity Picking Up, Consistent With Modest Earnings Growth

Source: LPL Research, Bloomberg, FactSet, 02/27/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Double-Digit Earnings Growth in 2025 May Be a Stretch

To be clear, LPL Research’s forecast for S&P 500 EPS in 2025 at $260 is an 8–9% increase over 2024, obviously very close to double digits. But both the bottom-up and top-down consensus estimates are calling for a 12% increase. Given actual earnings tend to come in 5–6% below estimates at the start of the year, tariffs probably aren’t in the numbers yet, and most economists aren’t factoring in much of a slowdown in the economy, our forecast seems much more realistic. Upside could come from an artificial intelligence (AI) productivity boost or continued margin improvement, while downside could come from harder-hitting tariffs and more retaliation from our trading partners. With this much uncertainty (including currency uncertainty), it seems prudent to factor in some downside. Hopefully we’ll be pleasantly surprised. The resilience of S&P 500 earnings estimates for the full year – down just 1.4% year to date – is encouraging.

Consensus S&P 500 Earnings Estimate Has Fallen As Expected but More to Go

Source: LPL Research, FactSet, 02/27/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

Watching Asian Export Markets

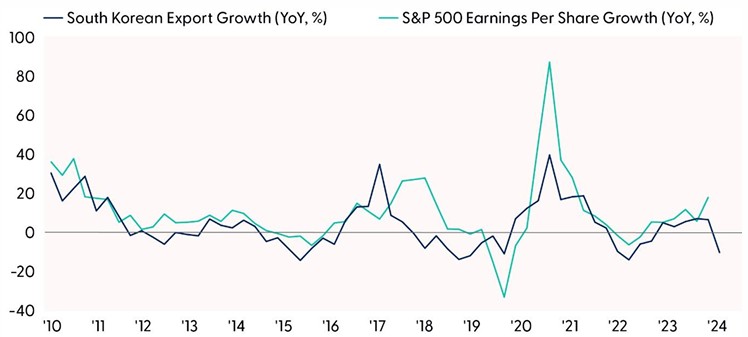

Another economic data point we monitor to gauge earnings trends is South Korean export activity. The U.S. earnings relationship historically has been tight, highlighted in the accompanying chart, indicative of the significant influence technology has on corporate America’s overall profits.

South Korean exports fell 10% year over year in January, the first drop since September 2023, and following a more than 6% increase in December. Taiwan’s exports are important to monitor as well, and the story is similar there.

Some of this reduction in trade activity is likely related to chip export controls to China, which highlights the risk to earnings going forward. Again, high-single-digit earnings growth is probably still a reasonable expectation, but a trade war with China that affects the global tech supply chain is a risk to tech earnings in 2025. The tech sector is expected to drive about half of S&P 500 EPS growth in 2025. Something to watch closely.

Dip in South Korean Exports May Signal U.S. Earnings Slowdown

Source: LPL Research, Bloomberg, FactSet 02/27/25

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Conclusion

Earnings grew rapidly in the fourth quarter with solid upside surprises, but the road ahead gets tougher. Companies not only did a good job managing costs and currency headwinds last quarter, but they also waded through policy uncertainty quite well. Doing that again in 2025 will be more difficult as tariffs go into effect and trade tensions potentially ratchet higher as the economy likely slows. Higher productivity following heavy technology investment may help, but with so much uncertainty, it seems prudent to factor in some additional earnings downside. We reiterate our forecast for high-single-digit growth in S&P 500 EPS in 2025, below current consensus estimates calling for a 12% increase. We believe that’s enough to support similar mid-to-high single-digit gains for stocks this year, though the ride to get there may be bumpy.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S. over international and emerging markets, growth over value, and large caps over small. However, we do not rule out the possibility of additional short-term weakness, as a lot of good news is still priced into markets and geopolitical uncertainty remains high.

Within fixed income, the STAAC continues to hold an overweight tilt in preferred securities as valuations remain attractive. However, the risk/reward for core bond sectors (U.S. Treasury, agency mortgage-backed securities, investment-grade corporates) is more attractive than plus sectors. In our view, adding duration isn’t attractive at current levels, and the STAAC remains neutral relative to our benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Mortgage-backed securities are subject to credit, default, prepayment, extension, market and interest rate risk. Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0003080-0225 Tracking #702857 | #702858 (Exp. 03/26)